For most people, finance is about staying afloat. Yet too many apps, wallets, and digital banking tools act like you’re prepping for a CFA exam. Between overly technical crypto wallets, budgeting tools that need a tutorial, and platforms with 15 steps just to send money, the average user often gives up before they begin.

That’s finally starting to change. A new wave of fintech platforms is focusing less on features and more on simplicity. Let’s see what we’ve got so far.

The problem with overcomplicated finance tools

Most traditional fintech platforms were built by engineers for people who think like engineers. That’s fine if you know what a seed phrase is or how to manage gas fees, but it leaves regular users feeling confused or locked out entirely.

Take MetaMask. It’s powerful, but the interface feels a bit too much. For someone who just wants to buy a bit of Ethereum or pay a friend back in USDT, the steep learning curve is a dealbreaker.

And it’s not just crypto. Even apps meant for budgeting or investing can bury important features under layers of tabs, toggles, or financial jargon. Add in poor translation or unclear UX, and you’ve got a recipe for abandonment.

That’s why many people open a finance app once and close it 30 seconds later. And thankfully, newer products are starting to understand that there is a problem and try to fix it.

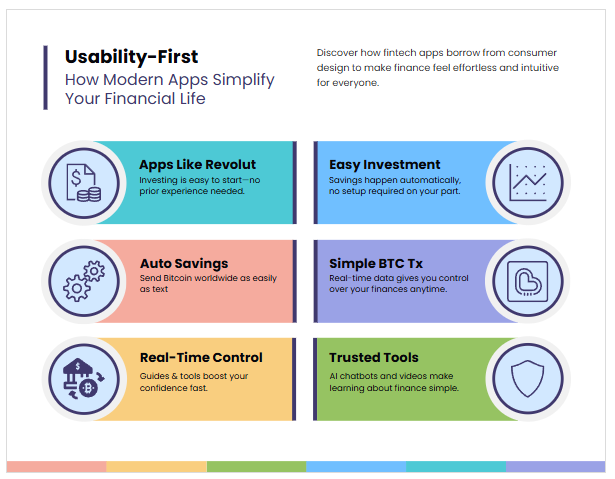

Usability-first fintech: What that looks like

Today’s smartest platforms borrow from consumer apps. Think swipes instead of dropdowns. Simple colors and charts instead of spreadsheets. A real person in chat instead of a support article from 2018.

Apps like Revolut, Chime, and Strike have redefined what “easy finance” looks like.

- Revolut lets you buy stocks or crypto in just a few taps with no trading experience. It also gives real-time exchange rates and built-in budgeting tools that feel more like swiping on a travel app than managing money.

- Chime makes saving automatic and invisible. It rounds up purchases and shifts the extra change to savings without any user setup. Its no-fee overdrafts and early payday features are big wins for people tired of old-school banking rules.

- Strike stands out for its simplicity in Bitcoin transfers. You can send BTC globally as casually as texting a friend, and it auto-converts to local currency when needed.

Each app tackles a different pain point, but they all share one goal: giving users financial control without a learning curve. Some platforms now even provide content that’s actually useful — short videos, walkthroughs, or AI chatbots that act like onboarding guides. These tools reduce stress and help users trust the process, which is half the battle when you manage your own money.

Crypto tools are catching up too

Crypto’s always been promising, but let’s be honest, most tools still feel like they were built in a developer’s basement. That’s changing fast.

Fold, for example, lets users earn bitcoin just for using a debit card. It even includes a spinning rewards wheel that feels more like a game than a banking feature. BitPay links your bitcoin wallet to a Mastercard with a clean, no-nonsense interface that doesn’t require knowing what a node is.

Coinbase’s “Learn and Earn” features reward people for understanding the basics, one concept at a time. And apps like Strike have removed most of the guesswork from crypto payments, especially for people sending money across borders. Some platforms even play into entertainment — a few add fun elements like a simple bitcoin slot machine that teaches interaction and risk in low-stakes ways.

When crypto tools are built like real apps instead of command lines, people actually use them.

Real users, real benefits

As a result of all these improvements, fintech apps have finally started to work for regular people who try to manage their real-life problems.

One mom in Texas uses Cash App to split school supply costs with her sister, all while keeping track of her monthly food budget. A retiree in Berlin uses Robinhood because he likes the simple graphs and one-tap investment options. Migrant workers use Strike to send money home without losing 8% in hidden transfer fees.

These are examples of what happens when usability takes priority. People feel empowered to manage their own money instead of waiting for someone else to do it.

So if you’ve always felt like finance tools aren’t for you, that’s changing fast, and now you can easily find one for your needs if you follow these simple tips.

What to look for in a friendly finance app

Here’s what actually matters when you’re picking a money app that doesn’t make you feel dumb:

- Clear language and transparent fees

- Mobile-first layout

- Beginner tutorials or support

- Optional crypto tools that don’t feel like another planet

- Extras like cashback, gamification, or budgeting tips

Some apps throw in everything — charts, analytics, DeFi features, but if you don’t use them, they’re just noise. If you can’t figure out how to send money or check your balance in under 30 seconds, it’s not your fault. It’s just bad design, and you’d better find a more user-friendly app.

Conclusion

Managing money doesn’t need to feel like decoding a puzzle. As more fintech platforms focus on intuitive design and clear user paths, everyday people, from teens to seniors, can finally take control without getting overwhelmed.

And if it takes a quick tutorial, a cashback nudge, or even a spin on a bitcoin slot wheel to get there, that’s perfectly fine because the end goal is confidence in how you manage your money.