Large enterprises manage customer portfolios that cross regions, industries, and economic cycles. When credit evaluations rely on scattered systems or slow manual review, the risk of misjudging exposure becomes much higher.

Bad debt develops gradually through outdated files, delayed checks, or customer stress signals that go unnoticed. These gaps eventually affect working capital strength and confidence in financial forecasts.

Digital tools help enterprises stay ahead of this problem by giving teams a clear, real-time view of customer health. For businesses handling long billing cycles or high order values, this kind of structure becomes essential for maintaining financial stability and preventing unexpected losses.

Key Ways Credit Risk Management Software Helps Enterprises Avoid Bad Debt

Enterprise credit teams often manage thousands of accounts across multiple countries. A dedicated platform helps them stay consistent while handling this scale. Many organisations rely on specialized credit risk management software to manage this complexity and strengthen their credit posture.

They also refer to global best-practice material from groups such as the ICC to support internal policies.

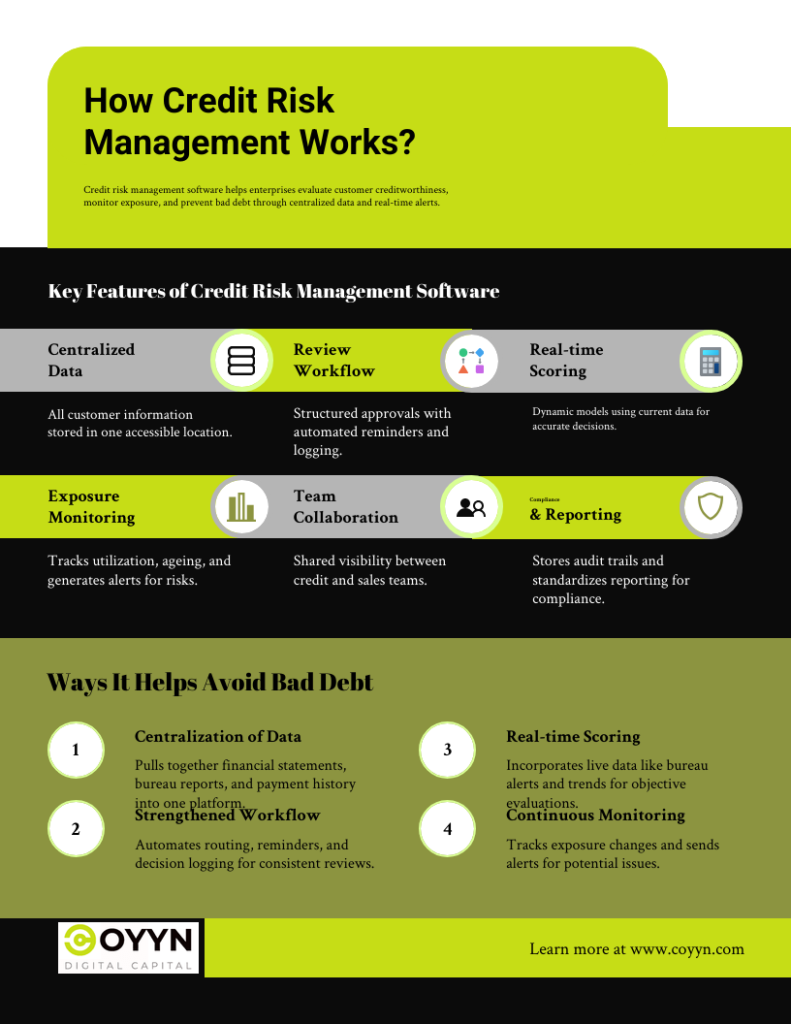

It centralizes customer information

Large organizations tend to store financial statements, bureau reports, payment history, and documents in different systems. A unified platform pulls everything together, allowing analysts to review accounts with complete and updated information.

This reduces the chance of granting limits based on incomplete data. Centralization also supports better handover between teams, especially when portfolios are transferred during restructuring or leadership changes.

It strengthens the credit review workflow

Enterprise approvals often involve several reviewers. Manual routing can cause delays, missed steps, or unclear ownership. Software creates a structured path for each application, uses automated reminders, and logs every decision. This keeps the process predictable across global teams and reduces friction when teams operate in different time zones.

It uses real-time scoring models

Static documents rarely reflect present conditions. Modern scoring engines add bureau alerts, behavioural patterns, industry trends, liquidity data, and payment history. These updated signals create more accurate and consistent credit evaluations.

Enterprises benefit from objective scoring because it reduces dependence on personal judgment, which can vary between regions or seniority levels.

It monitors exposure continuously

Exposure shifts with every order, dispute, or delayed payment. A central system tracks utilization, ageing, open orders, and dispute counts in real time. Alerts help analysts recognize unusual spikes early, preventing exposure from becoming unmanageable.

It identifies early warning signals

Risk often reveals itself gradually. A dip in ratings, delayed filings, rising disputes, or more frequent requests for extended terms can signal financial stress. Software collects these signals and highlights accounts that need immediate attention.

Teams can adjust terms, reduce limits, or add safeguards before issues escalate. This early intervention is often what separates a minor recovery effort from a large write-off.

It improves collaboration between credit and sales teams

Sales teams aim for smooth order flow, while credit teams focus on protecting revenue. Shared visibility reduces clashes. Sales can check limits and account status before confirming commitments, while credit teams gain context about upcoming deals or feedback heard directly from customers.

This shared system encourages healthier conversations and helps prevent last-minute order holds that create tension with key accounts.

It simplifies compliance and reporting

Enterprises follow strict audit and governance standards. Credit platforms store approval trails, maintain access control, and standardise documentation. Reports on exposure, concentration, ageing, and analyst performance can be generated quickly to support leadership and audit needs.

This consistency also helps when new policies are introduced because teams can adjust workflows centrally rather than training each region individually.

It enhances efficiency at scale

As enterprises grow, credit applications, renewals, and periodic reviews multiply. Automation handles repetitive tasks such as fetching bureau files, scoring accounts, and sending reminders. Analysts can then focus on complex accounts without losing accuracy.

This balanced workload becomes critical during mergers or expansions, where portfolios grow quickly, and teams need tools that can adapt without adding staffing pressure.

It reduces disputes and delays

Structured credit processes reduce order blocks, billing errors, and unclear terms. Smoother operations mean that when evaluations are consistent, customer relationships improve, and revenue cycles are protected. There are fewer interruptions for the customer, which strengthens long-term partnerships.

It protects long-term cash flow stability.

Stable cash flow requires disciplined risk management. Most importantly, through accurate scoring, continuous monitoring, and early intervention, there are fewer surprises for the enterprise.

Working capital becomes more stable, giving leadership a solid base for planning. This stability also improves forecasting because exposure and overdue-payment trends are easier to track and predict.

Conclusion

While no enterprise can eliminate credit risk entirely, through closing visibility gaps and tightening the evaluation process, unnecessary losses can be avoided. Most bad debt occurs when exposure increases without notice or when information is outdated at the time of approval.

Credit risk management software provides teams with the structure, clarity, and early warning capabilities that help them stay ready. With consistent scoring, strong monitoring, and better alignment across departments, enterprises can reduce delinquency, safeguard cash flow, and keep a more secure financial footing-even as the markets continue to shift.