Credit Cards

If you intend to be compensated for your everyday investing, the Coles Mastercard may be the choice for you.

While we all know Coles as someplace we can acquire our groceries, the organisation additionally offers good deals and also...

Read moreOld Navy Credit Card Evaluation: Big Benefits When You Shop at Old Navy

This credit card is a good fit for: Customers that patronize Old Navy usually and also wish to earn factors...

Read moreThe most effective travel charge card 2022

Should you get a travel bank card?If you travel frequently as well as spend for purchases with cash money or...

Read moreFirst Premier Charge Card Evaluation: Bad Alternative for Bad Credit History

There's no down payment, yet with numerous fees and a high interest rate, this card will certainly still cost you...

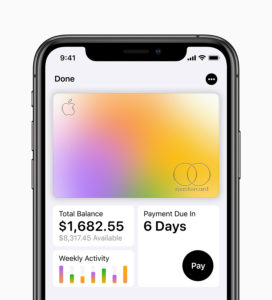

Read moreApple Credit Card Review

Use the Apple Card for acquisitions immediately with Apple, together with music as well as apps, and also with associate merchants the place you can also earn 3% Daily CashApple Credit Card ReviewPros-- Apple Credit Card Review Unique rewards for Apple and partner-merchant purchases: In addition to the greatest earnings charge on acquisitions at Apple, you will in addition obtain the three% Everyday Cash fee at buddies that personify Uber, Uber Consumes, Walgreens, Nike, and also in-store acquisitions at T-Cell. Good benefits charge on Apple Pay acquisitions: Seventy-four of the highest possible 100 sellers within the UNITED STATES settle for Apple Pay as well as continues so regarding include buddies. The company additionally claims 65% of all retail locations within the country help the contactless deal format ,3 so in case you store at any of these places, you've got a wonderful different to rake in benefits. The cardboard's incentives bill on Apple Pay purchases gets on the same level with as well as usually higher than the ideal flat-rate benefits playing cards readily available on the market.Monetary-management instruments: Apple brings its signature layout demands to a product that lacks visible satisfaction-- charge card statements. The interactive alternatives supply a brand new choice to perceive bank card interest and also the way your cost habits have an impact on it.Low finish of APR differ is amongst the many finest: If you happen to can receive it, the Apple Card APR lacks uncertainty among the lowest on the marketplace, particularly with regards to incentives playing cards. The too much finish of the vary is relatively reduced, as well, nonetheless you continue to don't require to obtain caught paying that charge. Apple Credit Card Review Cons-- Apple Credit Card Review Only cost it for Apple clients: The cardboard's worth originates from Apple Pay, which you'll be able to' t use with out an Apple device. Crappy benefits charge on non-Apple and non-Apple Pay purchases: The bodily Apple Card may look awesome, however there's no reason to hold it with you when you're open to having numerous charge card. Playing cards just like the Capital One Quicksilver or Chase Freedom Limitless supply a higher incentives bill on all acquisitions.Few benefits: As a monetary device, this card pays for little past the incentives on Apple acquisitions and Apple Pay. When you remain in search of a sign-up perk or choices like a totally free credit report rating or rental automobile insurance protection, this isn't the cardboard for you.Does not connect with budgeting apps: When you utilize a third-party application to preserve observe of your costs, it will certainly not can ingest your Apple Card spending .4. Revenues Aspects & Rewards.The Apple Card manages what it calls Daily Money, its personal design of cash-back rewards. Cardholders make 3% Each day Cash on Apple acquisitions, 2% on purchases made with Apple Pay, and 1% on acquisitions made at sellers that don't settle for Apple Pay. (The bodily card, like lots of playing cards going for a premium appearance, is manufactured from steel-- on this situation, titanium.).Apple additionally has a couple of associate merchants the location cardholders can obtain 3% Each day Money when utilizing Apple Pay, together with Uber, Uber Consumes, Walgreens, Nike, as well as T-Cell (in-store purchases solely) .2.Apple Card doesn't limit the amount of Daily Cash you perhaps can earn, and Every day Cash doesn't end. When you have actually got unredeemed Daily Cash if and also once you shut the account, Goldman Sachs will certainly both credit history it to your account, ship it to you electronically, or mail you a analyze .5. Compensatory Rewards.Each day Money consistently accumulates in your Apple Cash card, which you'll have the ability to then utilize on something that you simply spend for with Apple Pay. Consumers with out an Apple Cash account can redeem Each day Money as a press release credit rating .5.The right way to Get the Most Out of This Card. Make Use Of the Apple Card for purchases instantly with Apple, along with songs as well as applications, and with associate merchants the place you can even make 3% Daily Cash. It goes without saying when you buy Apple goods by another store, also one certified to promote Apple product, the 3% cost doesn't apply. In addition to that, utilize it at sellers that choose Apple Pay, except you may have a rewards card that earns a far better cost at that sort of vendor. For instance, if in case you have a card that supplies you higher than 2 aspects per $1 invested in leisure, also when the film show you go to approves Apple Pay, make use of the opposite card to acquire your tickets. Take full advantage of incentives by retrieving Each day Cash as a news release credit score. Utilizing Each day Cash via Apple Cash suggests you're not revenues benefits on these acquisitions, when you possibly can obtain 2% once again making use of Apple Card with Apple Pay.Apple Card's Different Choices-- Apple Credit Card Review.Budgeting tools. Charge card debt tool that displays just how the amount you pay on a monthly basis affects the amount of inquisitiveness you owe. Purchaser Competence.Apple Card is Goldman Sachs' very first charge card, to ensure that is unidentified territory, and also the shopper competence stays to be seen. On a useful observe, you perhaps can request for help as well as get assist via textual material, although it's uncertain if this service is accessible 24/7. The Apple Card doesn't supply a complimentary credit report ranking, not like the majority of its principal opponents.Safety Options.Quantity-less bank cards: Each the physical as well as electronic Apple Playing cards do not have any numbers on them. For non-Apple Pay deals on apps or website requiring a card, the Pockets application or Safari net web browser autofills a digital card amount. Integrated map expertise: Tap a purchase you don't recognize to tug it up in Maps and see the place it took place. Costs.Apple Card has just a couple of costs, partly as a result of it does not supply issues like money advancements or solidity transfers. Late or missed out on funds don't carry a cost nonetheless will lead to added curiosity building up in your steadiness. Merchants in lots of countries go for Apple Pay ,6 so when you find Apple Pay acceptance overseas, you'll be happy to understand the Apple Card does not cost a abroad transaction price. Source: Apple Credit Card Review

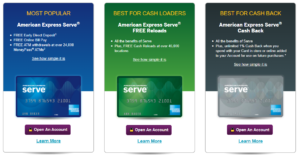

Read moreWalmart MoneyCard – Amex Serve Cash Back vs. FREE Reloads

Walmart MoneyCard - Amex Serve Cash Back vs. FREE Reloads With around a single American Express Serve Card to choose...

Read moreTJMaxx Credit Card: Is this a good Deal?

TJmaxx Credit Card is actually a decent selection for scoring special discounts at TJ Maxx, Marshalls, Sierra and HomeGoods shops....

Read moreMan Admits Using Fake Credit Cards In order to Steal Thousands At fifteen CT Lowe’s Locations

A fraudster admitted to using fake credit cards in multiple states - specifically Connecticut - to swipe a lot of...

Read moreThe way to avoid defaulting on your credit card

The coronavirus pandemic has placed a strain on millions of Americans. With spiking unemployment rates and businesses being pushed to...

Read morePractically everyone can get a credit card, states this marketplace expert – here’s what could be accessible to you

The two major kinds of credit are actually revolving and installment accounts. While aquiring a blend of both of the...

Read more