At a time when online shopping, mobile apps, and digital entertainment dominate, customers are looking for speed and reliability for their transactions. Consumers want payments to process instantly, whether they’re buying groceries through an app, booking a flight, or depositing funds into gaming platforms.

Behind the simplicity of a few clicks to pay online is advanced technology that has been designed to make each transaction secure and almost instantaneous.

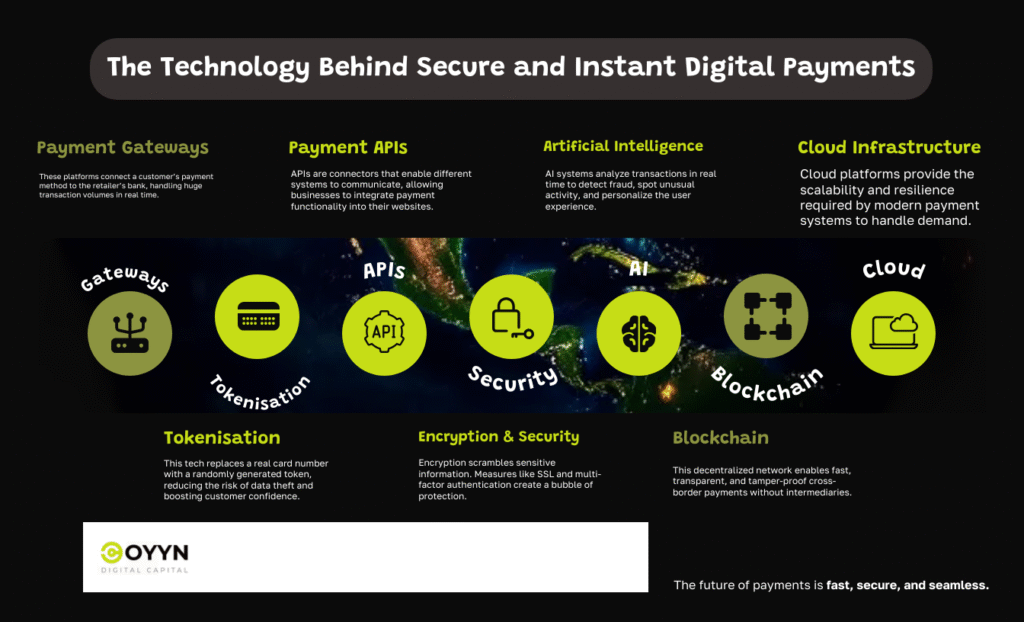

Payment Gateways

Digital payments wouldn’t exist without payment gateways. These are the platforms, or technologies, that connect a customer’s preferred payment method to the retailer’s bank. Modern payment gateways handle huge transaction volumes in real time, providing instant authorisation and keeping the user’s data safe.

These gateways can integrate with several payment options, including credit and debit cards, mobile wallets, and cryptocurrencies, making it a convenient experience for the consumer. Several industries rely on fast processing, like online gaming and iGaming. Fast payout casinos in Australia depend on payment gateways to provide users with fast, seamless transactions that keep them coming back.

Tokenisation

Tokenisation is one of the most important technologies that ensures secure payments. Instead of showing a customer’s real card number during a transaction, tokenisation replaces the number with a randomly generated string of characters called a token. This token is a one-off and useless to cybercriminals if intercepted, since it can’t be traced back to the original card’s data.

Tokenisation reduces the risk of data theft and gives customers confidence when making digital payments.

Payment APIs

Payment Application Programming Interfaces (APIs) are connectors that enable different systems to communicate with one another. Businesses use APIs to integrate payment functionality into their websites. This allows customers to complete purchases without being redirected to third-party sites.

For example, food delivery and ride-sharing apps rely on APIs to provide seamless checkouts. The transaction is streamlined, and any unnecessary steps are eliminated.

Encryption And Security Measures

Speed is a non-negotiable to most consumers, but they also need transactions to be safe.

Encryption is the tech behind secure payments that ensures sensitive information like PINs, passwords, and card details is scrambled. Advanced encryption standards and secure socket layer (SSL) protocols create a bubble of protection around the customer and merchant.

Multi-factor authentication is used to strengthen this security by requiring additional verification steps, like a one-time PIN or biometric login.

Together, these technologies ensure that security is ever-present in the background without slowing down transaction speed.

Artificial Intelligence

Artificial intelligence (AI) is changing how payment systems detect fraud and improve the customer experience. AI systems analyse transactions in real time and monitor patterns to spot unusual activity. It can then be used to flag or block suspicious payments before they’re completed.

AI also supports personalised payment experiences, like recommending the best payment method based on past user behaviours. AI integration allows businesses to provide a seamless and secure payment environment through fraud prevention and gain customer-focused insights.

Blockchain

Blockchain technology is changing how transactions are carried out. It enables fast and transparent payments across borders. Traditional systems rely on intermediaries to process payments, but blockchain operates on a decentralised network where transactions are validated and logged on a public ledger.

The delays associated with intermediaries are removed, and transaction fees are lower. Industries that require speed and trust use blockchain technology to deliver near-instant settlements in multiple countries, as there is no need for currency conversion.

Blockchain is also tamper-proof, ensuring that each transaction is permanently recorded.

Cloud Infrastructure

The silent supporter of all these technologies is cloud infrastructure. It provides the scalability and resilience required by modern payment systems.

There is a shift away from legacy hardware towards cloud-based platforms, allowing businesses to handle increases in demand without interruptions, like during holiday sales or sporting events.

Cloud infrastructure also allows for ongoing updates and integrations, ensuring payment systems are always compatible with new technologies. Cloud-based data storage enables real-time analytics, allowing businesses the opportunity to monitor transactions and respond instantly to issues, which results in a better experience for customers.