Bitcoin has been the largest cryptocurrency from the start and has transformed finance more than any other invention in the past few decades. However, there was always one criticism that it had to deal with and address. Bitcoin consumes huge amounts of energy and therefore has an impact on the environment.

With wider crypto acceptance, Bitcoin came under pressure to change its practices and provide a more sustainable product. In this article, we’ll discuss the measures and trends currently underway that are driving the adoption of a green Bitcoin.

A New Landscape

In recent years, there has been a significant change in public and official attitudes towards cryptocurrencies. Bitcoin has long been used in crypto gambling sites and other similar ventures. Those sites enable players to make fast and secure payments and place wagers without requiring personal data.

According to experts from CryptoManiaks, the landscape is now changing, and traditional financial businesses, such as banks, investment and insurance funds, and other risk-averse actors, are now accepting crypto as an integral part of their operations. This is one of the reasons more eco-friendly production efforts are put in place.

Environmental Challenges

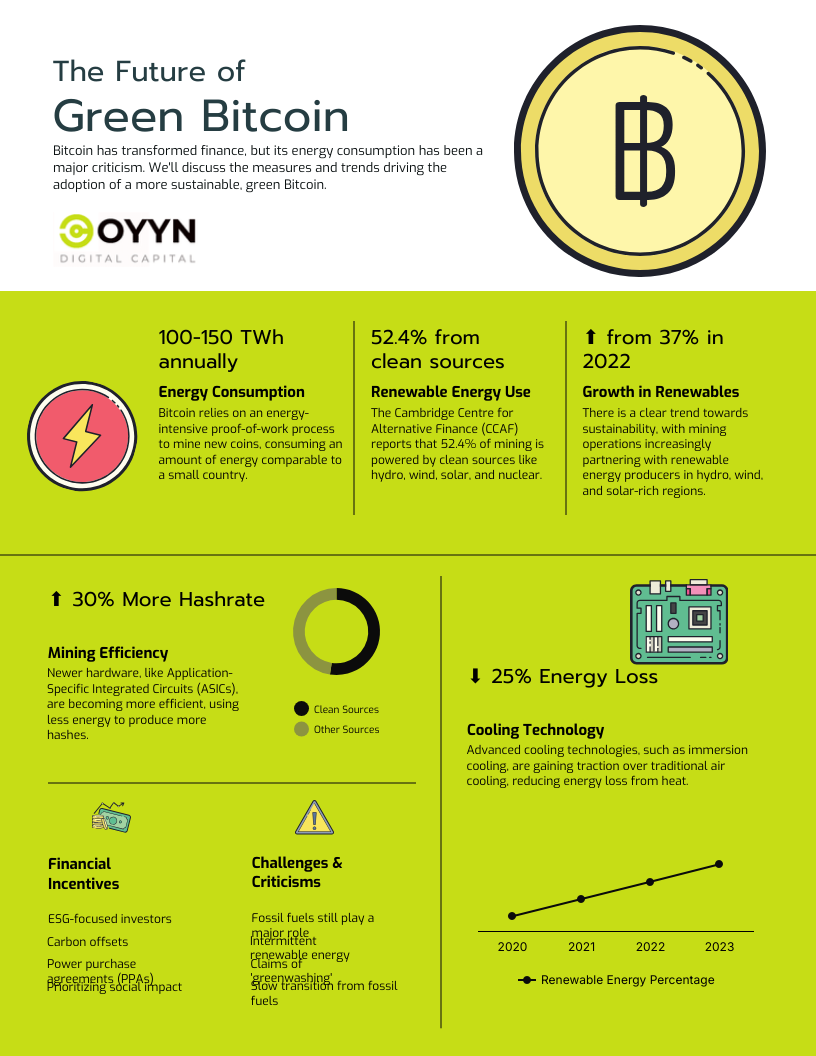

Bitcoin relies on proof-of-work to mine new coins. This is a very energy-intensive process. It’s estimated that Bitcoin uses about 100 to 150 terawatt-hours (TWh) annually, which is comparable to the output of a smaller country. Other cryptocurrencies have found ways to circumvent it by employing different methods to produce coins.

Bitcoin, on the other hand, doesn’t plan to give up on proof of work, but strives to produce the energy needed for it using environmentally friendly means. As interest in doing so increases, there’s also a demand for more coins, as Bitcoin is one of the most widely used cryptocurrencies.

Transition to Renewable Energy Sources

The biggest move towards green Bitcoin comes from the fact that the mining operations are now using renewable sources to produce the coins. At this point, as much as 50 percent of all Bitcoin mining is done by using renewable energy sources.

For example, the Cambridge Centre for Alternative Finance (CCAF) reported that about 52.4% is now powered by clean sources: 42.6% from renewables such as hydroelectric, wind, solar, and about 9.8% from nuclear. In 2022, that share was 37 percent, which shows a clear trend.

Hydroelectric power plants in Canada, Scandinavia, and South America are cooperating closely with the local crypto miners, and all the Bitcoin produced in these countries uses environmentally friendly means to do so. There are also efforts to get into power purchase agreements (PPAs) with energy producers in regions rich in wind and solar power.

Other, more innovative projects are also being introduced. For instance, otherwise wasted and flared energy, such as methane flaring, is being used to generate energy needed for mining. This cuts greenhouse emissions as well, since those gases are otherwise released in the atmosphere and can be harmful.

Mining Efficiency

Another change comes from the fact that the energy collected for mining is used.

ASICs (Application-Specific Integrated Circuits) continue to become more efficient. These newer hardware pieces use fewer joules of energy to produce more hashes. This makes each Bitcoin more profitable because there are fewer input costs with the same price of the final product.

Cooling is one of the most important processes during mining efforts. The equipment loses a lot of energy due to heat, and that’s the main reason it malfunctions. Cooling technology has improved greatly in recent years. Immersion cooling is gaining attention and slowly replacing air cooling.

Software and operational optimization have also gone a long way in recent years. Miners use dynamic load management and therefore avoid idle electricity draw. Smart contracts are also used to make sure operations are run when the electricity prices are at their lowest.

Financial Mechanism Supports Green Policies

Financial incentives are also put in place to promote green Bitcoin mining. These play an important role in the technical advancements.

ESG-focused investors are taking into account the environmental, social, and governance criteria. These investors place a portion of their funds towards crypto with the focus on green mining. Modern investors, especially young ones, care deeply about the social impact their companies will have and often prioritize it over profit.

Some companies buy carbon offsets to compensate for the emissions that they can’t avoid. This practice is controversial among green activists since not all carbon emissions cause the same damage, and it’s important to keep in mind the quality of the emission as much as the quantity.

Some Bitcoin investors also get into power purchase agreements (PPAs) with renewable energy producers. These are contracts with which miners buy power for a period of up to 20 years and pay in advance at the price set at the moment when the contract is enacted, thus saving in the long run, if the prices go up.

Challenges and Criticism

There are also major criticisms of the new green practices, mostly coming from experts and climate activists.

Fossil fuels still play a major role in Bitcoin production. Coal is no longer widely used, a trend that is also evident across various industries. But, natural gas and other non-renewable sources still supply most of the energy needed for mining. Efforts are being made to change these, but they are slow.

Solar and wind energy are only available intermittently. Therefore, they aren’t used as efficiently as they could be. The emphasis should be on storage and grid flexibility. That way, the investors can store the energy to be used when there are no conditions to produce it.

Some critics claim that these practices are, in a way, “greenwashing”. This means that some operations overstate how much of an effort they are making and how much their efforts are contributing to the green agenda.

To Sum Up

Bitcoin is very energy-intensive and has a negative impact on the environment due to the carbon footprint it produces during the mining process. Now, when it’s widely adopted and used by billions of people, it’s making efforts to address these issues. Both technical advancements and financial policies do this. The goal is to gain the energy needed to produce the coins from sustainable and less damaging sources, mostly wind and solar. A lot has been done in this regard in the past years.

However, there are still obstacles to overcome, some of which come from the limitations of solar and wind power on its own. As regulations in the crypto world become more detailed, these efforts will be further championed by public policy.