The limitations of conventional payment infrastructure have become increasingly apparent as businesses expand globally and digital commerce accelerates. Transaction fees, processing delays, and cross-border friction points challenge enterprises seeking more efficient financial operations. Neil Bergquist, co-founder and CEO of Coinme, envisions crypto-based payment solutions as a transformative alternative for businesses looking to optimize their transaction systems.

“Crypto has a lot of benefits to be used for payments because there’s no chargeback risk, there’s no Visa or Mastercard processing fees. It’s faster and cheaper as a payment rail, especially because it’s digitally native,” explains Bergquist. This fundamental efficiency advantage forms the foundation of Coinme’s B2B payment offerings, which aim to reduce costs while increasing transaction speed.

Beyond Fee Reduction: The Competitive Edge

The value proposition of crypto-enabled payments extends beyond simple cost savings. Traditional payment systems involve multiple intermediaries, each extracting fees and adding complexity. Credit card processors typically charge merchants between 1.5% and 3.5% per transaction, creating substantial overhead, particularly for businesses operating on thin margins.

Bergquist points out the parallels to existing commercial practices: “We’ve all seen the signs that say pay in cash and get a discount. I think we will see something very similar around digital currency and get a discount.” This model allows businesses to share the savings with customers, creating mutual benefit while potentially increasing conversion rates.

The elimination of chargeback risk represents another significant advantage for merchants. Unlike credit card transactions that can be disputed and reversed weeks after purchase, blockchain-based payments are immutable once confirmed. This provides businesses with greater certainty and reduces the administrative burden of managing payment disputes.

For international operations, the benefits multiply. Cross-border remittances using traditional banking rails can take days and incur substantial fees. “There’s $50 billion a year of cash that’s sent from the United States to Latin America, and that’s cash to cash, which is surprising,” Bergquist notes. “Well, now you can put that cash into a Coinme location, get crypto, and send that anywhere faster and cheaper than a lot of existing solutions.”

Integration Challenges and Coinme’s Infrastructure Solution

Despite the compelling advantages, businesses face significant hurdles when implementing crypto payment systems. Technical complexity, regulatory uncertainty, and integration with existing financial workflows present substantial barriers to adoption.

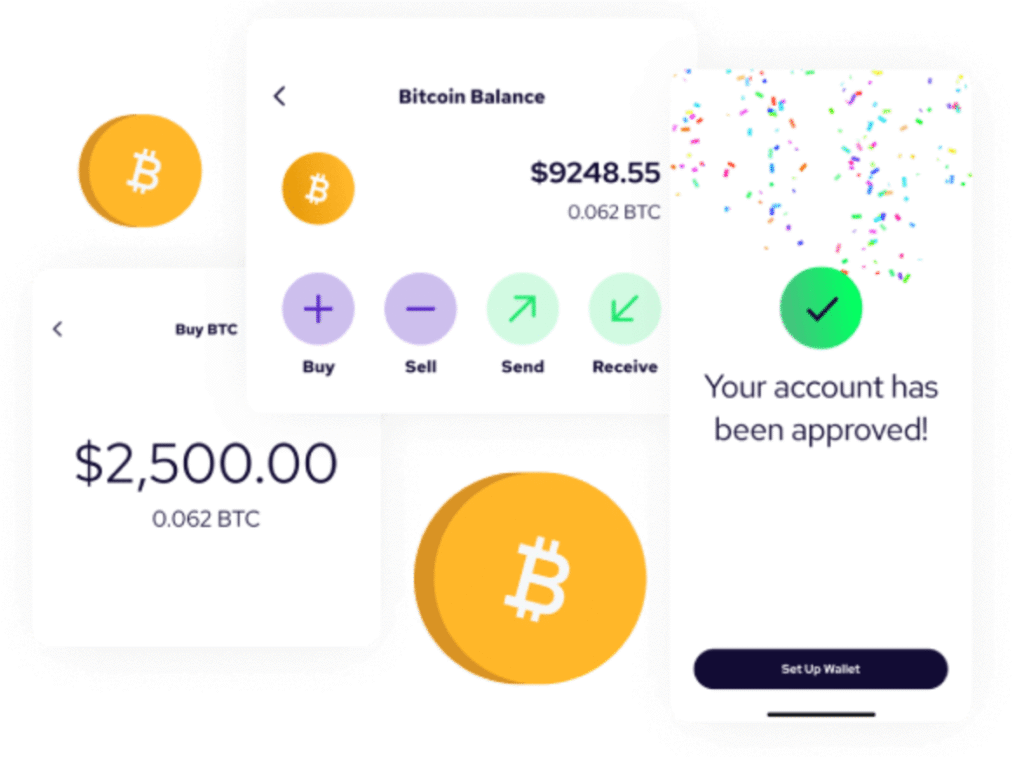

Coinme addresses these challenges through its comprehensive Crypto-as-a-Service platform. “We’re a platform that provides crypto infrastructure,” Bergquist explains. “That infrastructure is the ability to create an account and conduct KYC [know your customer], so that Coinme and our partners can be compliant with various state and federal regulations, but also so customers are able to use a debit card or cash to buy or sell digital currencies.”

This infrastructure-first tactic enables businesses to integrate crypto payment capabilities without building complex systems from scratch. Coinme’s platform handles the technical complexities while allowing partners to customize the user experience according to their specific needs.

“If you have a token and you want someone to be able to buy it, you’re going to need to offer a fiat payment processing to be able to purchase that token, and that’s where Coinme comes in,” Bergquist clarifies. “So we’re able to provide those payment rails where someone can actually be on a website or in an app and be able to actually purchase a token with cash.”

Real-World Applications and Use Cases

The application of crypto-based payment systems spans multiple business contexts, each with unique requirements and opportunities.

Retail Merchants

For traditional retailers, the appeal lies primarily in reduced transaction costs. By accepting cryptocurrency payments and offering modest discounts to incentivize their use, merchants can increase profit margins while potentially attracting tech-savvy customers.

“Because the merchants don’t have to pay so much to Visa or Mastercard, they theoretically could or should offer a discount,” Bergquist suggests. This strategy enables retailers to pass on a portion of their savings to customers while still retaining higher net proceeds than they would through conventional payment methods.

Cross-Border Businesses

Companies operating internationally face complex challenges with traditional payment systems. Bank transfers between countries typically incur high fees and can take several days to complete, creating cash flow disruptions and administrative complications.

Crypto-based alternatives offer near-instantaneous settlement regardless of geographic boundaries. For businesses managing global supply chains or serving international customers, this efficiency translates to improved operational agility and reduced working capital requirements.

Subscription Services

Recurring billing presents unique challenges for businesses, including payment failures, chargebacks, and administrative overhead. Crypto-based subscription systems can address many of these issues through programmable payments and reduced intermediary involvement.

These applications represent just a sampling of the potential use cases. As the technology matures and integration becomes more seamless, new applications will likely emerge across various industries and business models.

The Integration Pathway

Coinme’s platform accommodates different integration depths, from basic crypto acceptance to comprehensive payment system redesign, allowing businesses to start with limited implementation before expanding as they gain comfort with the technology.

The company’s API-based architecture facilitates integration with existing systems, reducing disruption during implementation. For businesses considering crypto payment integration, Neil Bergquist recommends a measured approach that prioritizes operational objectives: Understanding how payment efficiency aligns with broader business goals provides the foundation for successful deployment.

The Future of B2B Payments

The convergence of traditional and crypto-based payment systems appears increasingly likely. Market projections support this trajectory, with cryptocurrency payment adoption expected to grow by a 21.3% average annual rate in the U.S. from 2022 to 2025.

International B2B blockchain transactions are projected to exceed $1.7 billion by 2025, indicating substantial growth in enterprise adoption. This expansion reflects growing recognition of the efficiency gains possible through blockchain-based payment systems.

Neil Bergquist envisions a future where cryptocurrency functions not merely as an investment asset but as practical infrastructure for everyday commercial activities. “Imagine if you had your investment portfolio, stocks, bonds, gold, and bitcoin, and you could spend those assets as if they were your checking account,” he posits.

This integration of investment and payment functionality represents a fundamental shift in how businesses approach financial operations. Rather than segregating capital into distinct usage categories, a more fluid model emerges where assets maintain growth potential while remaining available for operational needs.

The transition to this model will likely occur gradually as businesses evaluate the practical advantages against implementation costs. However, as integration becomes simpler and regulatory frameworks mature, the adoption curve may accelerate significantly.

For businesses seeking competitive advantage through operational efficiency, crypto-enabled payment systems offer a compelling opportunity to reduce costs, improve cash flow, and enhance customer experience. As Coinme continues developing its B2B infrastructure, Crypto-as-a-Service, these capabilities will become increasingly accessible to enterprises of all sizes.